Yemen’s oil and gas sector faces precarious future as peace talks intensify

Yemeni oil and gas production has slowed to a trickle in recent months after the Iran-backed Houthis attacked oil export terminals to cut off the Saudi-backed government’s vital revenue source, despite renewed hopes for a peaceful resolution to the country’s eight-year war.

Although the violence has cooled since landmark negotiations began in April between Riyadh and the Houthis – who control a large swath of northern Yemen – analysts told S&P Global Commodity Insights that oil production and investment would not increase until a comprehensive peace agreement is in place.

And with various factions excluded from the talks and the UN-recognized government plagued by infighting and secessionist sentiment, experts say that remains a long way off.

“I remain skeptical until peace is truly established,” said Carole Nakhle, CEO of Crystol Energy. “Confidence in government policies, political stability, availability, safety and security of infrastructure are just some of the factors that will shape investment outlook in the sector.”

Yemen has never been a major producer compared to nearby Saudi Arabia and the UAE, but the Middle Eastern country, which sits on key international shipping lanes, has 3 billion barrels of crude and 17 tcf of gas, according to the US Energy Information Agency. Oil production peaked at 450,000 b/d in 2001 but has collapsed since then as a result of maturing fields, underinvestment and the war, which pitted a Saudi and UAE-backed coalition against the Houthis and has left hundreds of thousands dead.

Today the country is producing between 7,000 b/d and 10,000 b/d of oil, analysts said, all of it refined locally. Low production and a lack of exports have hit Yemen’s finances since oil contributed 63% of government revenues before the war, according to the IMF.

Most of Yemen’s crude is produced by state-owned firms Yemen General Corporation for Oil, Gas and Mineral Resources and PetroMasila, while a clutch of foreign firms, including Austria’s OMV, Canada’s Calvalley and Indonesia’s Medco Energy, have stuck around. OMV, which in January agreed to sell its three Yemeni oil blocks to Canada’s Zenith Energy, told S&P Global in a statement that it produced 600,000 barrels in 2022, or roughly 1,644 b/d.

Patchy exports

As recently as 2014, Yemen was producing 125,000 b/d of crude from the Masila, Marib and Shabwa basins, but exports came to a grinding halt once the fighting started in 2015, as did the Yemen LNG project, an economic gamechanger in which TotalEnergies is the major stakeholder with 39.6%. Export grades include light sweet Masila and the extra light sweet Marib Light.

In 2017, the government resumed oil production, but exports were patchy, oscillating wildly month-to-month from 18,000 b/d to 81,000 b/d, according to S&P Global Commodities at Sea. However, after a truce expired in October, the Houthis – who have repeatedly tried without success to capture Marib oil fields – struck the Bir Ali and Ash Shihr loading terminals on the Gulf of Aden, reducing exports to zero.

The warring sides have been at an impasse ever since, with the Houthis demanding the lion’s share of future oil revenues to pay public sector and military salaries, Rafat al-Akhali, a fellow at the Blavatnik School of Government at Oxford University and a former Yemeni minister of youth and sports, told S&P Global.

The group has also warned foreign oil companies against signing deals with the internationally recognized government and is selling imported refined products to further squeeze government revenues.

“We don’t comment on political situations,” said OMV. TotalEnergies did not respond to a request for comment, but has previously said it “obviously hopes that it will be possible in the future to restart LNG production.” Experts say doing so would require a security agreement with a single governing entity.

“TotalEnergies might be among the first to return to Yemen since they have invested capital, time and effort in the country, so they would be keen on recouping at least some of their initial investment,” said Nakhle. “New investment might be cautious but if a major company like TotalEnergies successfully returns to the country, it will encourage other companies to follow suit.”

Peace deal

Hopes for peace finally grew in March when Riyadh agreed to normalize relations with Iran and then held official negotiations with the Houthis. Widespread fighting has not resumed, despite the ceasefire expiring.

“It is too early to say with certainty that the negotiations in Sana’a will succeed, but it is clear that an atmosphere of peace is taking hold in the region,” Houthi official Mohamed al-Bukaiti wrote on Twitter in April.

Nevertheless, the path to peace is lined with obstacles. Some parties wonder how Saudi Arabia can be simultaneously a player and a mediator. Meanwhile, the kingdom – whose oil infrastructure has been targeted by Houthi drones in recent years – has not yet included the Yemeni government, including its powerful Presidential Leadership Council, which is plagued by infighting, in the negotiations.

The council’s vice-president, Aidarus al-Zubaidi, who has been backed by the UAE, is pushing for the south to officially split from the Houthi-controlled north. Akhali said a more likely scenario was for the country to remain divided into several regions controlled by different parties. For now, neither the Houthis nor Yemen’s government are willing to make concessions.

“The best case scenario that we do get an agreement signed, but I highly doubt that it will stand,” said Akhali. “There is no zone of possible sustainable agreement at this time.”

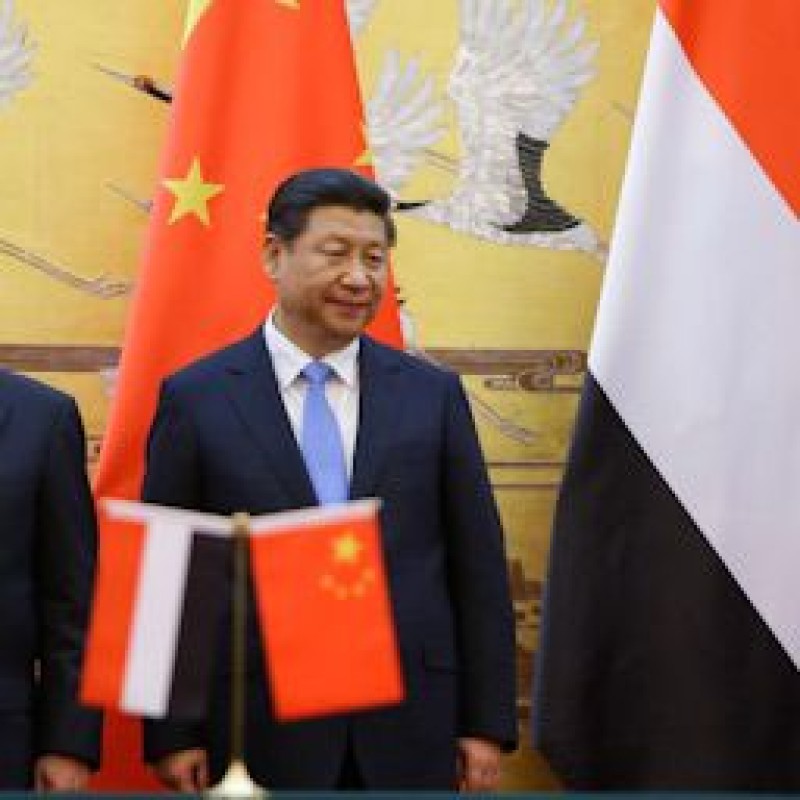

RIYADH — China has reiterated its steadfast position in support of Yemen’s unity, sovereignty, and territorial integrity, underscoring…

The International Federation of Journalists (IFJ) announced that 111 journalists and media workers were killed across the globe in 2025, underscori…

Aden — Southern and eastern regions of Yemen, under the authority of the internationally recognized government, are witnessing a new phase of…